Looking for the process to print forms 1099 and 1096 in QuickBooks? If yes, then your search ends right here. These forms can be easily printed using some set of steps. Read the post to find out what those steps are. But before establishing a 1099 vendor in update QuickBooks Desktop, it is essential to examine the IRS standards initially to recognize if your vendor falls under the group of an Independent Contractor. Note that forms can only be printed in single-user mode, and you must have pre-printed 1099 and 1096 forms to perform this. You can also choose to e-file your 1099 forms to the IRS. For more details, make sure to read the post till the end. Or contact our team at +1(844)405-0907 and let them help you with the process.

Steps to print the form 1099/1096

Verify your 1099 details through QB Desktop 1099 wizard.

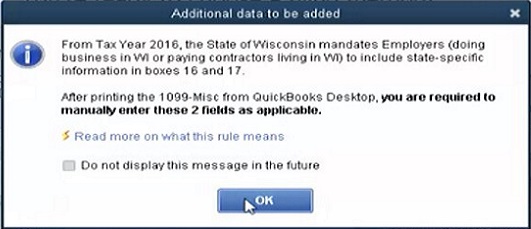

In the wizard, at step 6, choose a filing method and click on Print 1099s. Read the message and click OK to get the print.

- At first, choose the range (of date) the 1099s were paid from and click OK.

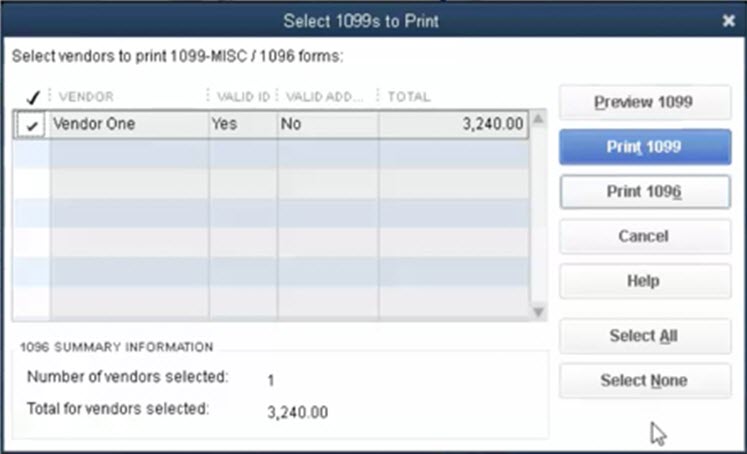

- And then, go for the form 1099(s) you wish to print and click the Print button.

- Opt for the 1099(s) you want to print and click the Print 1099(s) button.

- Click on Preview 1099 and check the alignment. To align the form:

- Here, go for File on the top menu bar

- Also, Click on Printer Setup.

- After that close 1099s/1096 from the list in Form Name

- And then, click the Align button and adjust alignment as needed.

- Hit a click on OK, and then OK again to save your changes.

- Opt for 1099(s) you wish to print and click Print 1099(s).

- And then, click the Print 1096 button to print 1096.

- And this would end the process for you

By the end of the post, we expect the user successfully able to print forms 1099 and 1096 in QuickBooks successfully using the set of steps we have listed above. However, if there is any query, or if the user is unable to eliminate the issue using the set of steps we have shared in this post, then in that scenario talking to our QuickBooks Technical personnel at +1(844)405-0907 is all that we suggest. We are a team of technically sound professionals who work round the clock to provide instant support and assistance.

Read Also: stridepost

Stride Post Latest News

Stride Post Latest News